Market Signals

90% of farmers globally: 90% of farmers globally expect to maintain or increase spending on bio-based crop protection and sustainable practices, according to the Global Farmer Insights 2024 by McKinsey.

34 investments: In the Q3 2024 Round-Up for investments in regenerative food and ag, RFSI reported 34 investments totaling $834.5 million for the third quarter. The top investment theme was food companies, followed by data platforms.

40% more loans to farmers: Farmers are taking out loans at a rate and scale not seen in years as weakened crop prices weigh on the agricultural sector, according to a report from the Federal Reserve Bank of Kansas City.

From the Trail

What are the business models for regenerative agriculture ventures?

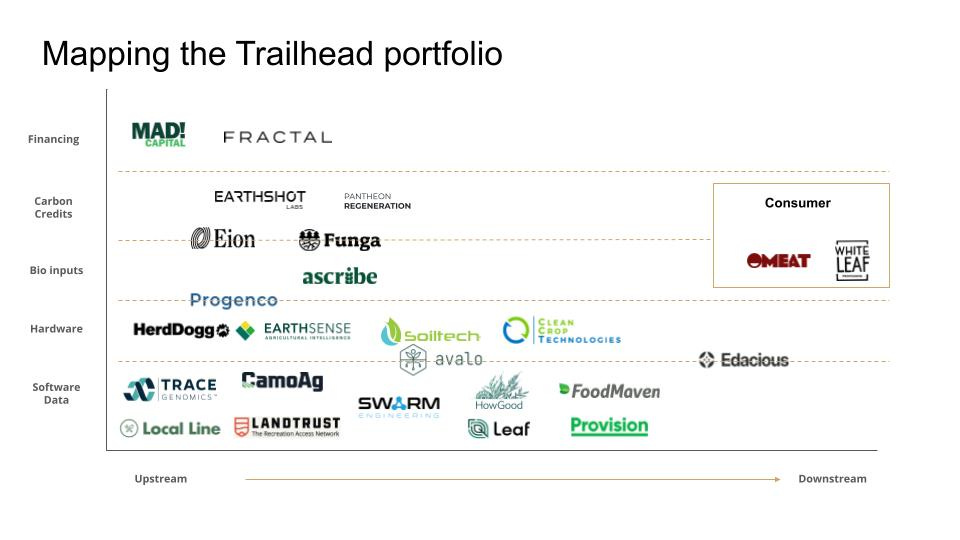

In the last four years, we’ve found five business models that are most common across the ventures in which we’ve conducted due diligence and invested.

Selling software and data

Selling biological inputs & outputs

Selling hardware

Selling carbon credits

Charging fees for structuring agriculture financing

This is not an exhaustive list (there are other business models we’ve come across like cultivated meat and alternative proteins (Omeat)), and many startups are leveraging more than one business model.

Business models can be organized into both upstream operations (models tied to the land or farm operations) and downstream operations (models once you leave the farm through the supply chain).

We’ve mapped our portfolio into this business model framework below. For example:

Fractal: Agriculture financing - Upstream

Funga: Biological inputs & carbon credits - Upstream

EarthSense: Hardware - Upstream

FoodMaven: Software - Downstream

Each business model has its advantages. Here is what we look for when vetting companies for each:

Software & Data: We look for high-margin businesses growing at +2-3x YOY, generally selling to enterprises, addressing critical gaps, and digitizing legacy aspects of the value chain.

Biological inputs & outputs: We look for ventures that replace or augment chemical inputs to increase farm resiliency and improve human health outcomes. We seek solutions that 1) create benefits across carbon, water, biodiversity, and agronomy, 2) limit negative externalities, and 3) don’t require any major practice change for the land steward.

Hardware: We look for opportunities to improve labor efficiency, output quality/quantity, and safety across the full supply chain of food production and distribution.

Carbon credits: We look for models that increase value to the land steward, provide additional revenue streams, integrate strong MRV, and provide a solution to global corporations seeking to hit their net zero commitments.

Agriculture financing: We look for creative new structures and the ability to offer or enable more flexible and innovative financing than traditional community banks, while aligning with the changing needs of farmers to help facilitate the incorporation of regenerative practices.

Founder Fundamentals

How much money should you raise? For founders determining how much money they should raise for their next round, there is no simple formula. Raise too little and you’ll be fundraising again too soon. Raise too much and you’re facing greater dilution, with money you don’t need but might be convinced to spend. We recommend that founders determine what they need to raise by mapping what they need to accomplish to successfully raise their next round. This means outlining the specific milestones over the next +24 months that will demonstrate to the next round’s investors that your company is on the right track. This requires 1) calculating your current monthly burn, 2) determining what additional resources are needed to hit those key milestones (new hires, etc.), and 3) adding in a margin of safety. For more, check out this article from TechCrunch (10 minutes).

Portfolio Updates

Fractal was featured on Agriculture.com. After a year of operation and $8 million invested in farm businesses, Fractal is investing another $7 million to help farmers scale their operations.

Nic DeCastro, the CEO of LandTrust, was interviewed on the Farm4Profit Podcast.

Clean Crop Technologies has developed a financing relationship with CSC Leasing to help bring its seed decontamination technology to more growers and processors.

SWARM Engineering won “AI-based AgTech Solution of the Year” in the 2024 AgTech Breakthrough Awards Program.

What We’re Reading

Consumer appetite for regenerative agriculture. A 2024 Consumer Trends Report found a growing consumer appetite for regenerative agriculture. Morning Star.

The potential of enhanced rock weathering. Enhanced rock weathering could store gigaton levels of carbon in the future, but startups in this space will need to navigate challenges of verifying how much carbon is stored. Mongabay.

Regenerative organic certified products show growth. Regenerative Organic Certification (ROC) products grew from $40M in sales in 2023 to $170M in sales in 2024 (+4x YOY!), driven by consumer adoption and retailers like Whole Foods prioritizing new certifications. Food Navigator.

Is Big Ag serious about regenerative agriculture? A report by the New Climate Institute investigated the 30 largest multinational food and agriculture companies and found that they are embracing the term, “regenerative agriculture,” without changing business-as-usual practices. New Climate Institute.

Rewilding the midwest. Farmers in America’s heartland are restoring swaths of prairie with the government’s help in order to reduce nutrient runoff and increase biodiversity. New York Times.