The GuidePost: November 2022

Vence acquired by Merck Animal Health, A Look Back at RFSI 2022, Our New Impact Metrics, and more!

Big news from the Trailhead Capital portfolio: Merck Animal Health has acquired Vence! The company’s virtual fencing for cattle and livestock management will complement Merck Animal Health’s portfolio of veterinary pharmaceuticals, vaccines and animal intelligence solutions. Congratulations to founder and CEO Frank Wooten and the whole Vence team!

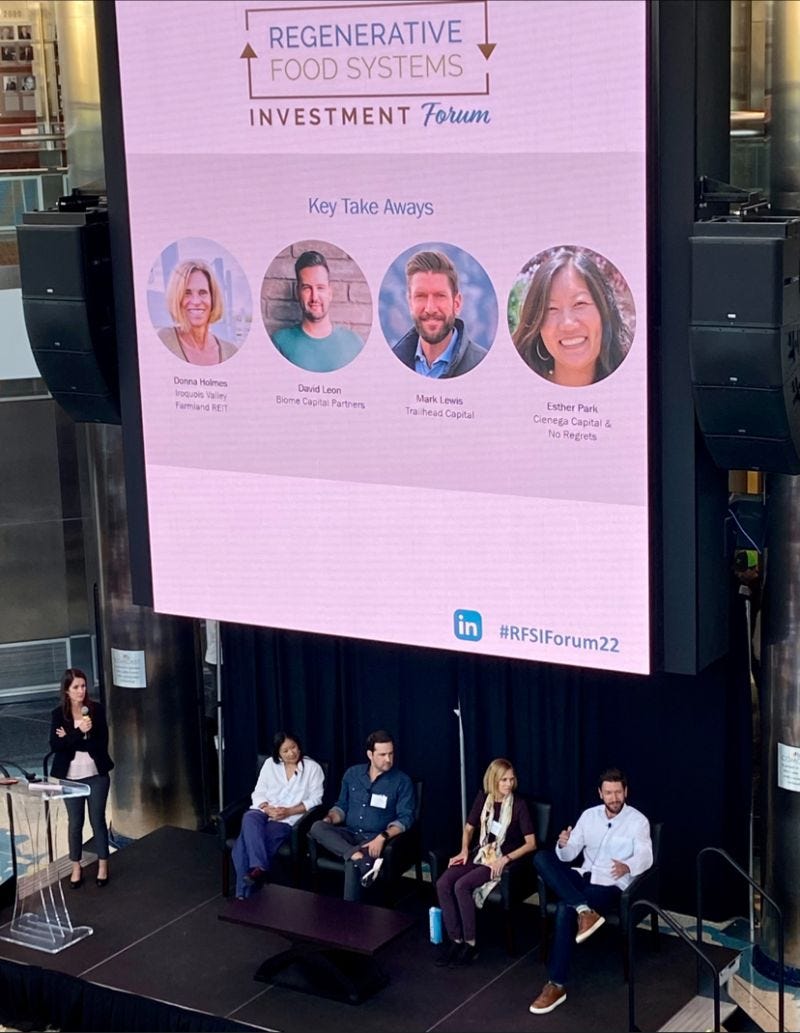

We also recently co-sponsored The Regenerative Food Systems Investment (RFSI) Forum in Denver, CO, the only event in our industry that brings together investors, capital activators, and critical stakeholders working to build a more resilient food system. What did we learn? That regeneration technology is still severely underfunded, that impact investors still need to be educated around the benefits of regenerative agriculture, and that farmers are still foundational to the future of this industry. Most of all, though, we all learned that the opportunities in this space have never been greater — or more needed — than they are right now, and we’re proud to be part of the community pushing this conversation forward. Here’s a great recap of the event from RFSI.

Also, as an official Ambassador to ReFed’s Food Waste Funder Circle, we were excited to be featured in the organization’s Monthly Member Spotlight over the summer. ReFed is doing important work combating food waste and we were honored to be included.

And an ask: Mark Lewis is a member of the World Economic Forum’s Working Group on Carbon Credits, as part of the Crypto Sustainability Coalition. They are currently working on a set of recommendations for carbon credits on-chain and need your input. In an effort to collate as much information and insight into the marketplace as possible, we’ve pulled together a survey to better understand the pain points and opportunities at play. Please let us know your thoughts and share around! Click here to access the survey.

Are you really making the impact you think you are? Prove it.

Trailhead Capital is now working with a company called Proof to collect comprehensive first-in-the-industry ESG and impact metrics around regenerative agriculture. Our goal? To accelerate the transition to a regenerative world through impact-driven investments.

Vence

Virtual fencing for cattle and livestock management.

Telesense

Using sensors and artificial intelligence to monitor temperature, humidity and carbon dioxide levels in stored grain and other crops.

Funga

Harnessing forest fungal networks to address the climate crisis.

BBC Video: Wood Wide Web: The Galaxy Beneath Our Feet

HowGood

The world’s largest product sustainability database.

New Hope Network Announces Strategic Partnerships with SPINS and HowGood

Quinn rolling out “climate friendly” label on snacks in 2023 with HowGood

SWARM Engineering

A SaaS platform helping cut costs, reduce waste and deliver environmental benefits across the agri-food supply chain.

Omeat

Developing a scalable and sustainable approach to producing cultured meat.

Trace Genomics

Using data science to activate hidden insights in this soil.

EarthSense

Building ultracompact, autonomous, teachable robots for crop breeders, scientists, and growers.

Provision Analytics

A single platform to capture and analyze food safety data.

Provision Announces Expanding into Latin America with Grupo Delcen Partnership

Provision Analytics helping Alberta companies compete globally

Courageous Capital Stewards Podcast: Mark Lewis was recently featured on the Impact Finance Center’s Courageous Capital Stewards podcast with Dr. Stephanie Gripne

Bessemer Venture Partners: Roadmap: Soil Sequestration

Food Navigator: 'Our culture compels us to act,' ADM and PepsiCo strike regenerative agriculture agreement

Forbes: Can Vegans And Ranchers Work Together To Rebuild The World’s Soil?

New York Times: Patagonia Founder Gives Away the Company to Fight Climate Change

Successful Farming: USDA Awards Nearly $3 Billion for Climate Smart Ag Projects

Quartz: Sustainability is the wrong goal for businesses that care about climate change

Venture Unlocked: Why emerging managers are a critical part of a well rounded venture portfolio

Discover opportunities across our network of transformational companies, including Omeat, Trace Genomics, Earthshot and more.